Valuing China

CIO Robert Horrocks, PhD, explains how China has been taking care of long-term business and this bodes well for the future growth and stability of its economy and markets.

It’s proving a tough year for equities, particularly for China stocks. China’s posture toward Russia over the war in Ukraine, zero-COVID lockdown policies and the overhang of regulatory interventions have fueled media scrutiny, negative market sentiment and waves of sell-offs.

But we believe allowing this current barrage of challenges to lessen portfolio exposure to the world’s second biggest economy would be a mistake. To understand what is happening we need to dig deeper. When we do, we find that some of the arguments for reducing or excluding China from portfolios don’t hold merit.

China’s growth prospects

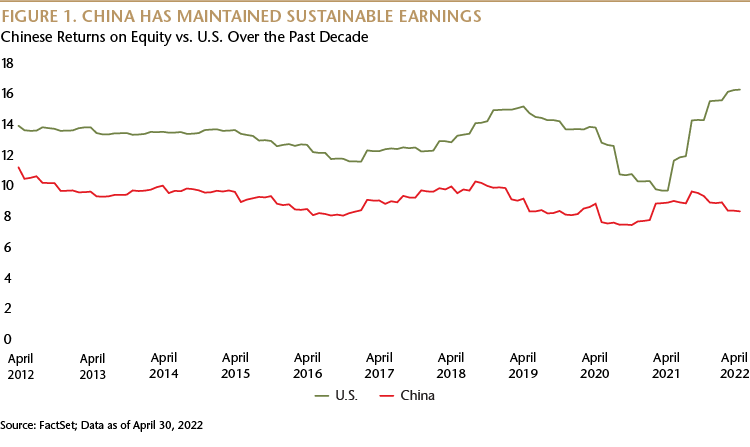

It’s true that China has been focused on tackling issues it thinks are a threat to its long-term economic stability—income inequality, unequal access to health care and education, speculative bubbles and anti-competitive practices, to name a few. But the fundamentals for many Chinese companies remain strong. The MSCI China Index’s return-on-equity (ROE), for example, has been fairly stable over the past 10 years and hasn’t materially deteriorated, either in absolute terms or relative to the market’s valuation level. In contrast, ROEs in the U.S. have hit unprecedented levels.

But it could be argued that this performance has been helped by the U.S. not addressing income equality and the social issues that China has. China has been managing its economy with a long-term goal of improving the living standards and prosperity of its citizens and that is also good for the future health of its markets.

The valuation story

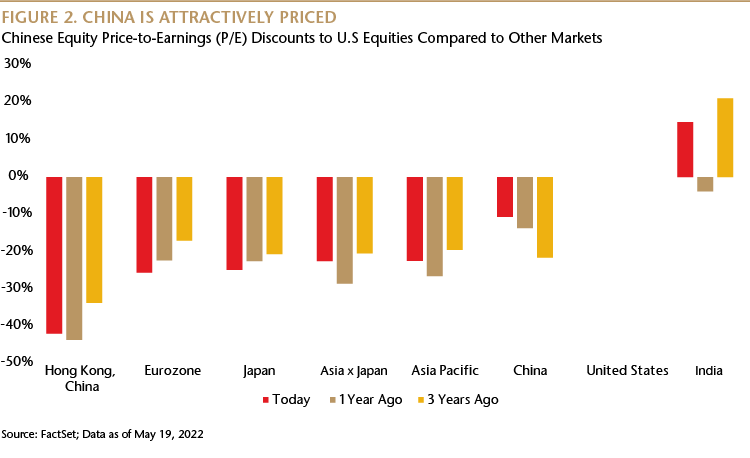

Recent interventionist efforts by the Chinese government have often been misunderstood or mislabeled in the West as anti-capitalist and this has been one of the biggest drivers of negative sentiment toward Chinese stocks. As a result, the price-to-earnings (P/E) discounts of Chinese equities compared with U.S. stocks has dramatically widened. What’s more, many of the companies that have attracted regulatory attention—in technology, real estate, finance, health care—have been and will continue to be a great service to China’s economy and to businesses and consumers globally. Their investment and innovation are world-leading. They have expanded choice, enhanced convenience, improved access to information and lowered the cost of consumption.

So there are a fair amount of undervalued businesses that are in important growth sectors of the Chinese economy. In the long run, we believe the step-up in regulations should foster more sustainable business practices and with it a resetting of sentiment.

How stable are Chinese equities?

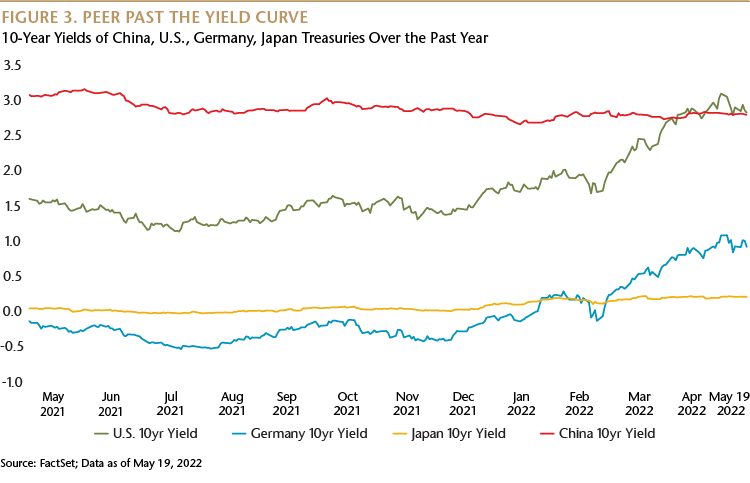

Stability and risk are both relative. For example, many investors have considered the U.S. a safe haven—one that offers a more stable financial system and can continue to generate good rates of return at high valuations. However, in April, 10-year U.S. and Chinese treasury yields converged for the first time in a decade as U.S. investors sold off government debt as the Fed tries to get a grip on rising inflation, a slowing economy and worsening financial conditions.

Meanwhile, China has started to loosen its monetary policy. This easing stance, seen against a tightening bias in the U.S. to counter inflation, strengthens the investment case for Chinese equities as well as broader emerging markets. And while the rising prices we are seeing are generally deemed to be a global phenomenon and commodity prices in China have climbed, the margins of manufacturers in China have proved more resilient. That’s a reflection in part on the world’s continued dependence on China for a wide range of goods.

Long-term growth platform

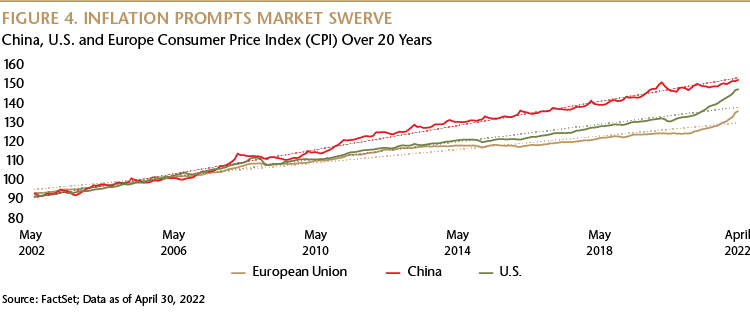

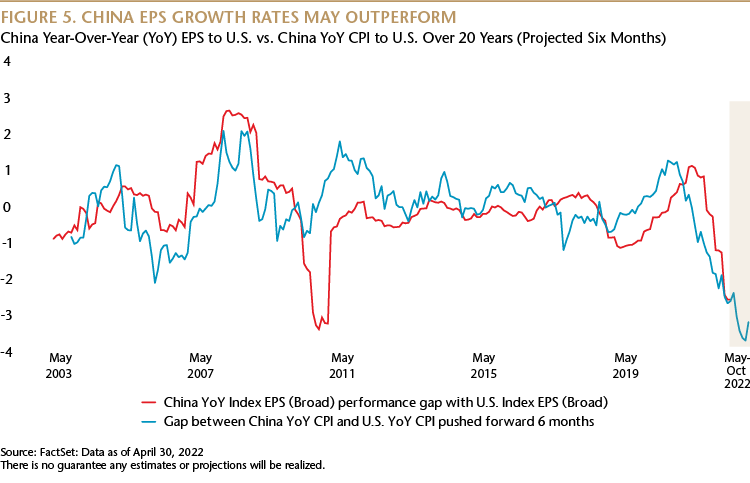

Looking ahead, as the Fed attempts to rein in inflation, rising rates will put a further squeeze on the U.S. economy and earnings growth potential. Indeed, we can look at the gap in the Consumer Price Index (CPI) between the U.S. and China and match it with the gap in EPS growth rates between the two countries. If we project six months ahead, what we find is that we are likely to get a period where the U.S. is squeezing growth to contain inflation just as China is doing a moderate stimulus to lift its economy.

Navigating China

In spite of the headwinds China faces today—geopolitical, COVID-related or otherwise—how we think about investing in China has stayed the same. It is by and large a well-managed economy that has quality companies that we believe will deliver growth across market cycles. Even as China’s economic momentum moderates, well-run businesses will still have opportunities to outperform their competition, whether through market share gains or better cash flow and balance sheet management.

Undoubtedly, navigating China’s economic and corporate environment calls for rigorous research and stock selection. Company fundamentals make a difference. Strong management teams, resilient business models and an adaptability to change are key qualities that can cushion companies against macro uncertainty and short-term volatility from issues like regulation.

History shows that well-managed businesses can adapt and subsequently thrive and we believe China’s long-term macro-economic prospects provide a platform for this. Excluding or reducing China from an emerging-market portfolio may mean missing out on some best-in-class global companies over the long term.

Robert Horrocks, PhD

Chief Investment Officer

Matthews Asia

MSCI China Index: measures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges.

Return-on-Equity (ROE): the measure of a company's net income divided by its shareholders' equity.

Price-to-Earnings: a ratio for valuing a company that measures its current share price relative to its earnings per share.

Earnings-Per-Share (EPS) Growth: calculated as a company’s profit divided by the outstanding shares of its common stock.

US Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

EU CPI/Harmonized Index of Consumer Prices (HICP): list of the final costs paid by consumers for items in a basket of common goods.

China CPI: measures changes in the prices paid by consumers for a basket of goods and services.