Latin America's Long-Term Potential

Portfolio Manager Jeremy Sutch, CFA, and Chief Investment Officer Sean Taylor assess the issues besetting the region’s key markets—from domestic challenges to geopolitical headwinds—as well as their structural strengths, and whether prospects may brighten with the onset of a U.S. rate-cutting cycle.

Watch NowKey Takeaways

- The Federal Reserve’s higher-for-longer interest rate strategy and the strong U.S. dollar have impeded the economies and markets of Latin America this year.

- Shifting domestic politics and government interventions have added uncertainty and weakened investor confidence.

- We are cautious in the short term and anticipate more volatility in the region’s markets in the run-up to the U.S. presidential election.

- Over the long term, we expect Latin America’s strength in natural resources, its structural attributes and digital innovation to be significant traits that will create investment opportunities.

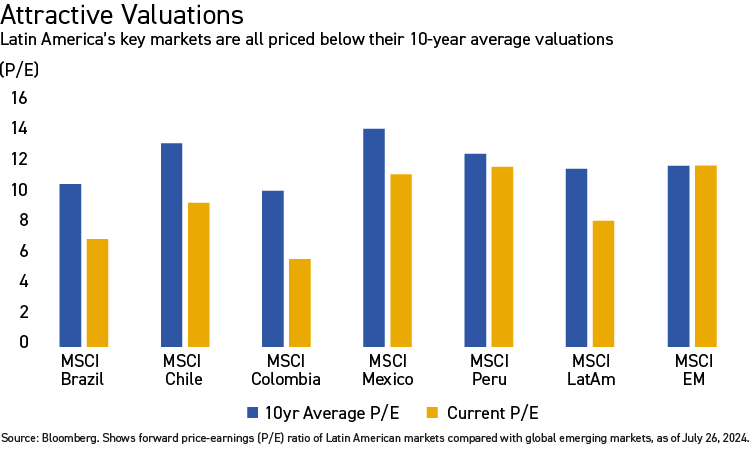

- Latin America’s markets are cheap compared with other regions and global monetary easing may provide a macro boost that feeds through to improvements in equity performance.

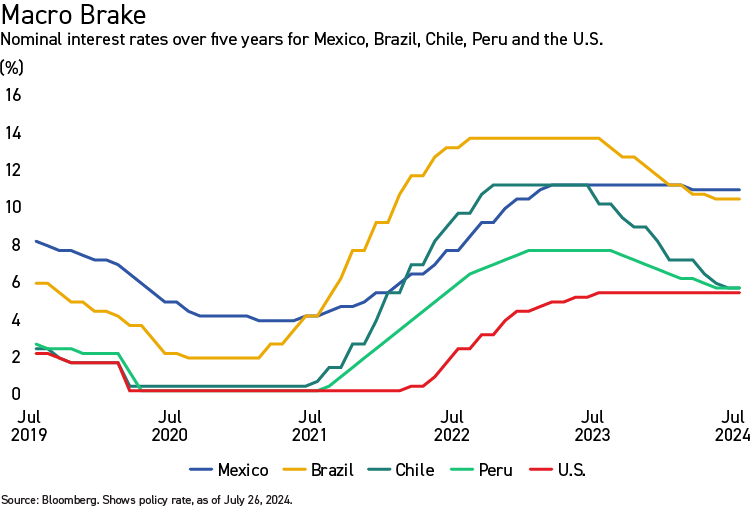

As the U.S. Federal Reserve signals its parameters for entering a rate-cutting cycle, perhaps as soon as September, there may be no region in the world that is in more need of the economic tailwind that could bring than Latin America, in our view. While most emerging markets would stand to benefit from the increased liquidity, cheaper credit and weaker U.S. dollar that lower interest rates would likely encourage, the magnitude of such a macro boost would be notable for Latin America given its relatively high interest rates and large cyclical industries.

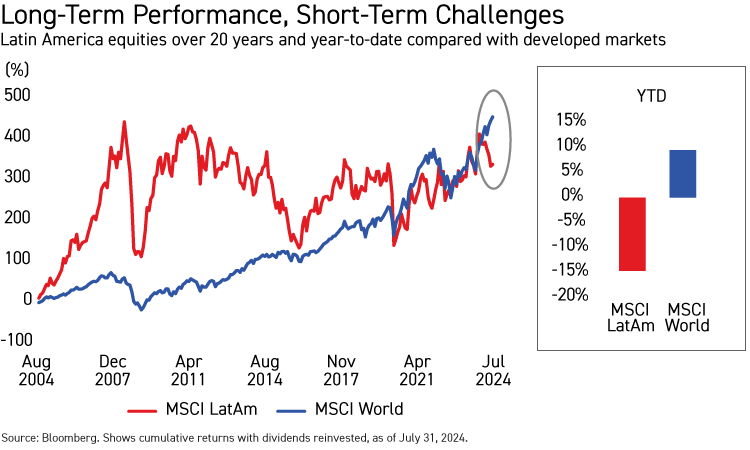

In practice, it’s not that simple. Latin America has been a great hunting ground for investors in years gone by, but it now faces considerable headwinds. Emerging markets elsewhere have performed well recently as their economies begin to build momentum after the pandemic and tech-heavy hubs like Taiwan benefit from the rapid growth of artificial intelligence (AI). But key Latin American markets including Brazil and Mexico have underperformed. After a relatively strong showing last year, a weak start to 2024 has been assailed by domestic disruptions, political uncertainty and ongoing macro headwinds.

In this report, we assess the state of Latin America’s markets and economies, the hurdles they face and the potential they have to boost long-term performance from new and familiar drivers when an easing monetary environment begins. .

THE REGION

Several economies in Latin America are supported by cyclical industries, like commodities and manufacturing, which depend heavily on favorable interest rates and macro environments. Over the past few years, however, as inflation took hold in many parts of the world, interest rates rose in the region and stayed elevated as the Federal Reserve’s higher-for-longer rate strategy entrenched and guided macro policy across the globe.

In addition, the domestic political environments of Latin American countries have become more uncertain and have had a disruptive impact on their economies and markets. While countries including Argentina, Colombia and Venezuela have historically been characterized by political instability and economic volatility, the markets of Latin America’s two biggest and most important economies, Brazil and Mexico, were jolted this year by domestic events. Mexico saw a re-energized left-wing government with a strong mandate come to power, and in Brazil, state-owned enterprises (SOEs) have been subject to government intervention and there are concerns pervading over the country’s tax reforms and fiscal controls.

Macro headwinds and domestic uncertainties are two key ongoing impediments to the growth and stability of economies in Latin America, we believe, and their impact has been borne out with the underperformance of their equity markets, particularly in Mexico and Brazil.

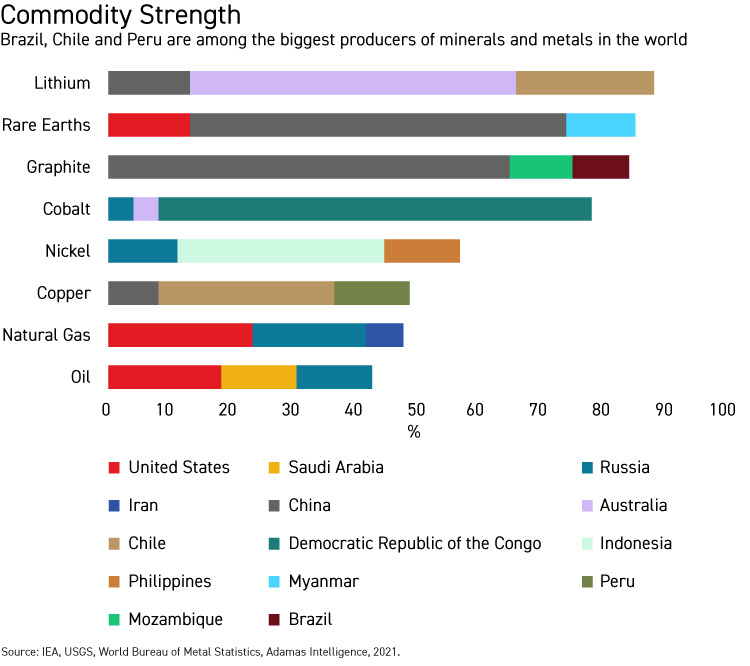

Concurrent with these near-term challenges, we think Latin America has a number of strengths which could benefit equity performance in the longer term, particularly when the global monetary environment eases. The first is the region’s richness and depth in commodities, a characteristic that has long attracted emerging market investors to the region. In addition to their strength in soft commodities and agriculture, a number of countries are also key energy producers and critical players in global green energy supply chains. For example, electric vehicles (EVs), EV batteries, wind and solar technology, require a mix of “new” and “old” metals and minerals, including copper, iron, graphite, lithium and zinc. Brazil is one of the biggest iron ore producers and a strong graphite producer; Chile and Peru, on the other hand, are the world’s biggest copper producers, and Chile is also strong in lithium and zinc.

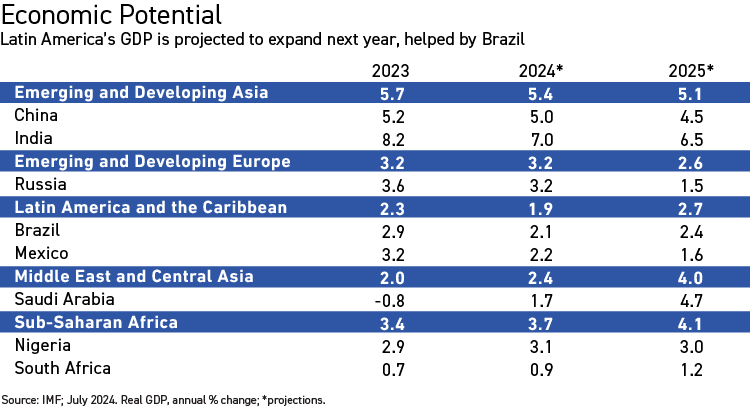

Secondly, we think the region’s economic fundamentals and trading attributes are a long-term strength. During the pandemic, Mexico, Brazil and Chile moved quickly to increase interest rates and, largely as a result, inflation is now relatively well contained and their underlying economies are in good condition. Latin American economies are also embedded in world trade and supply chains, mainly with the U.S. and Asia. And they are increasingly recipients of inward investment, particularly Mexico, as global companies seek nearness to end markets and supply sources. Looking ahead, according to the International Monetary Fund’s (IMF) July World Economic Outlook, Latin America is one of three emerging market regional economies projected to grow year-on year from 2024 to 2025. The IMF projects that the region will grow by 2.7% in 2025 compared with 1.9% in 2024, due in part to “supportive structural factors,” such as acceleration in hydrocarbon production in Brazil.

A third attribute, which is more of a potential tailwind for equity performance in the long term, is valuation. Latin America is cheap. Its equities have a trailing price-to-earnings (P/E) ratio discount to the S&P 500 Index of about 65%. And compared to emerging markets as a whole, Latin American equities trade at a P/E discount of about 43%. On paper, at least, if the region grows as the IMF predicts and interest rates come down, low valuations could be a positive catalyst for equity performance.

Conclusion

We think there are striking features about Latin America that have the potential to deliver robust economic growth and positive returns for investors in the years ahead—these include the region’s leading role as a producer of key commodities, its strength in international trade, and its digitization and innovation across industries. But Latin American equities are cheap for a reason. Many markets are grappling with potentially significant changes in their domestic, political landscapes and almost all of them will be affected, sentiment-wise, by the geopolitical noise generated in advance of the U.S. election in November.

It will be an uncertain and bumpy road in the coming months, in our view. Only when the global monetary environment starts to ease and the domestic and international political dust starts to settle, will the region’s economies and markets have an opportunity to perform at a meaningful level. We think this warrants an approach that is conservative in the near term but also positioned to leverage strengthening long-term growth trends.

KEY MARKETS

Mexico

Mexico is viewed as a structural story supported by four pillars of growth:

- Large remittances from citizens working overseas, in excess of US$63 billion in 2023;

- Pension reforms which could bring positive developments in terms of inbound annuity flows;

- Increasing Foreign Direct Investment (FDI), in part supported by nearshoring from overseas companies;

- Closer U.S. trade links. Mexico is now the biggest importer of U.S. products and the U.S. is now Mexico’s biggest export market.

Mexico is also seen as having conservative fiscal and monetary policy and a strong democracy with robust checks and balances. On the other hand, Mexico’s large informal sector can be construed as a headwind for economic development and growth and the oligopolistic characteristics of some of its industries are often seen as encouraging poor management and a vulnerability to corruption.

More recently, Mexico’s markets have been hurt by political uncertainty. The landslide election of the left-wing party of Claudia Sheinbaum has triggered worries about potential constitutional changes, particularly regarding judicial independence and electoral reforms. While we don’t believe Mexico’s structural journey will be derailed, we think it will take time for the market to understand the objectives of the new government as the policies of Sheinbaum’s administration unfold.

“Over the next few months there will be a lot of noisy political rhetoric. Ultimately, we think the bark will be worse than the bite given the importance of Mexico as a political ally and an economic partner to the U.S.”

Positioning

Currently, we are more defensively positioned, and we think this is the right stance for the next three to four months as key events unfold. Firstly, in September, newly appointed Congress members will be taking their seats and that potentially creates a risk, in our view, that Sheinbaum’s predecessor and mentor Andres Manuel Lopez Obrador sees an opportunity to push through sweeping reforms. Also in September, there is the 2025 budget plan and there are concerns about rising spending levels. In the coming weeks, there will also be more cabinet appointments and these could provide a steer on the kind of reforms that Sheinbaum is seeking.

Perhaps most importantly, there is the U.S. presidential election in November. And it’s not just the outcome of the vote that may impact Mexico’s markets but also the campaigning. Both the Democrat and Republican parties share a hard stance against Mexico, whether it's on issues of immigration, drugs or trade. In addition, Mexico is now a key destination of investment from Chinese companies as they seek nearness to their U.S. markets and seek to benefit from Mexico’s trade agreement with its neighbor. Economically this is a good development for Mexico but geopolitically it is a tricky tightrope to walk.

Over the next few months there will be a lot of noisy political rhetoric, in our view. Ultimately, we think the bark will be worse than the bite given the importance of Mexico as a political ally and economic partner to the U.S., but the U.S.-Mexico relationship will be a priority for Sheinbaum to manage.

Opportunities

Despite our near-term caution we are cognizant of Mexico’s long-term structural story. Near term, we see potential in exporters to the U.S. and in companies with exposure to American markets that are in positions of strength. Longer term, we see some great franchises with very strong market positions and sensible capital allocation, for example, with bottling companies, convenience stores, banks—particularly on the micro-finance side—and discount retailers.

Brazil

Like Mexico, Brazil has its own inherent strengths. It remains a commodity powerhouse both on the hard and the soft side. It is the world’s largest exporter of soybeans and corn, and efficiencies are improving due to innovations in crop production and logistics. However, macro headwinds, political disruption and fiscal concerns are weighing on investor sentiment.

Brazil has always been a classic “risk-on” market and it's not easy for it to perform when interest rates are high and the U.S. dollar is strong. On top of that, like Mexico, there are some domestic uncertainties. The corporate interventions by the Lula government in SOEs is the kind of activity that is headline-grabbing and disruptive for markets. Secondly, there are questions over tax reforms and, related to that, concerns over the government’s finances and budget deficit. These kinds of issues can lead to a lack of confidence by international and local investors in a country’s currency and equity markets, which can in turn breed more inflation and make it more difficult to reduce interest rates.

“Despite the macro and political landscape, a lot of Brazilian companies are generating good earnings growth, winning business and market share, and many care about corporate governance.”

Positioning

Brazil is ultimately a cyclical story. It is highly tethered to global macro variables and demand and supply dynamics. For its economy to grow and its markets to perform, it needs rate cuts in the U.S. that show a clear, downward trajectory. Hand in hand with rate cuts, we would expect to see the U.S. dollar weaken which would also be a catalyst for Brazil’s economy and equity markets.

The other big picture variable that could change Brazil’s fortunes relates to China. Iron ore and soybean shipments to China represent over 60% of Brazil’s exports. When demand in China for commodities is resilient, Brazil benefits from increased and more stable export revenues. Recently, however, oversupply in China’s EV and EV battery markets has softened demand and prices for EV minerals and metals from Brazil and Chile which has hurt their economies and negatively impacted their equity markets. So a meaningful recovery in some of China’s sectors would be beneficial to Brazil.

Despite the macro and political landscape, a lot of Brazilian companies are generating good earnings growth, winning business and market share, and many care about corporate governance. When we meet companies, the narrative that we get is often more upbeat than what the data is telling us.

Opportunities

One of the key long-term themes in Brazil is digitization and there has been rapid success across sectors and industries, including railways and public transportation and in the evolution of Brazil’s fintech sector. Many observers view Brazil’s central bank as among the most progressive in the world when it comes to digitization. This innovation drives productivity which drives financial inclusion which are long-term positives for Brazil.

Within the banking sector, we see opportunities for neobanks to coexist with conventional banks. Brazil’s neobanks are cheap, have healthy loan growth and interest rate cuts could drive more volume and help asset quality. More generally speaking, Brazil’s large, traditional banks have gone through difficult periods in recent years but are now in an environment which is poised to be better in the medium term, in our view.

More broadly, drug retailers, private hospital operators and soft commodity players that are geared to moving product to ports, have attractive potential, in our view. There is also a robust retail mall culture in Brazil which has strong tenant sales and footfall. So like Mexico, we are cautious for the months ahead but further out we believe new innovations and traditional commodity strength will serve Brazil’s economy and markets well.

Chile, Peru, Colombia, Argentina and Venezuela

Looking across Latin America, we would say Chile is a relative bright spot. Its market has been supported by prudent economic policies, declining interest rates and a robust copper export sector. Earnings have started to recover and valuations are attractive. This relative economic stability and favorable investment climate gives Chilean equities a positive contrast to the more volatile aspects of Brazil and Mexico, in our view.

Among other relatively large economies in the region, Peru and Colombia are both experiencing social unrest and political turbulence. Peru is the second-largest copper producer in the world and has been quite proactive in terms of mining concessions. In Colombia, the president's attempts at decarbonizing have been serious but with the economy so reliant on oil, gas and coal, it's a difficult transition. In Argentina, President Javier Milei is pushing a bold economic reform agenda to tackle inflation and debt but it will require considerable fiscal austerity. We see a lot of political pressure, uncertainty and volatility down the road. As for Venezuela, it has had a very challenging period in recent years and that looks set to continue given the doubts cast over President Maduro’s declared victory in the recent election.

Exposure to Latin America in Emerging Market and Global Portfolios

- Latin America and its country markets typically make up relatively small components of global and regional indexes, while markets in Asia are much larger components. This reflects both the size of Asian economies and their public markets, and their market capitalizations.

- A diversified approach to Latin America which accommodates exposure to other regions, including other emerging markets, should be a consideration, in our view.

- Adding exposure to Latin America in an emerging markets or international portfolio provides diversification and exposure to potentially contrasting growth themes and geographic drivers that can counter weakness or complement growth in other markets.

Long-Term Traits

- Consumer Markets and Structural Growth A number of Latin American economies, including Brazil, Mexico, Colombia, Chile and Peru, have robust domestic consumption and structural growth attributes, including proximity to the U.S., diverse global trade links and strong FDI. Consumer spending is expected to increase as the region continues to urbanize and middle-class populations expand.

- Natural Resources and Energy Transition Latin America is rich in natural resources and a leading exporter of food commodities, like corn and soy, and minerals and metals, like copper and iron ore. Its wealth of minerals and metals has also enabled the region’s economies to become critical players in the global supply chains of renewable and alternative energy industries.

- Infrastructure and Manufacturing Infrastructure development is expanding in Latin America in areas like transportation, telecommunications and utilities. Manufacturing capacity is also deepening, particularly in Mexico, which is a major exporter of machinery, steel, electrical equipment, chemicals and food products.

- Technology and Innovation Latin America may not have tech hubs like Asia but its young, entrepreneurial class is supporting startup ecosystems that are flourishing in cities including Sao Paulo, Mexico City and Bogota. More generally, fintech, e-commerce, digital services and cybersecurity have become strong themes and key pillars of growth.

- Trade Inter-regional blocs like the Pacific Alliance (which includes Chile, Colombia, Mexico and Peru) and the Mercosur (which includes Argentina, Bolivia, Brazil, Paraguay and Uruguay), and pan-regional pacts like the United States-Mexico-Canada Agreement (USMCA), have enhanced economic growth and the overall business environment in Latin America.

Jeremy Sutch

Portfolio Manager

Matthews

Sean Taylor

Chief Investment Officer

Matthews

Nearshoring: The practice of relocating a company or some of its business operations to its home country or end market in order to better manage costs, operations or supply chains.