The Era of the ABA Trade?

The U.S. market has outperformed the rest of the world over the past decade but it may fade, making international equities a timely and overlooked opportunity.

The Era of the ABA Trade?

As a student of developing economies since college in the late 70’s, I was given a life-changing opportunity in 1989 to participate in the launch of the first U.S.-based Asian emerging markets mutual fund, the Newport Tiger Fund. We didn’t call it an emerging markets fund. We were Asia snobs, viewing other developing nations with investible markets as second-class affairs. Emerging Markets investing was in its infancy, and we were proud regionalists.

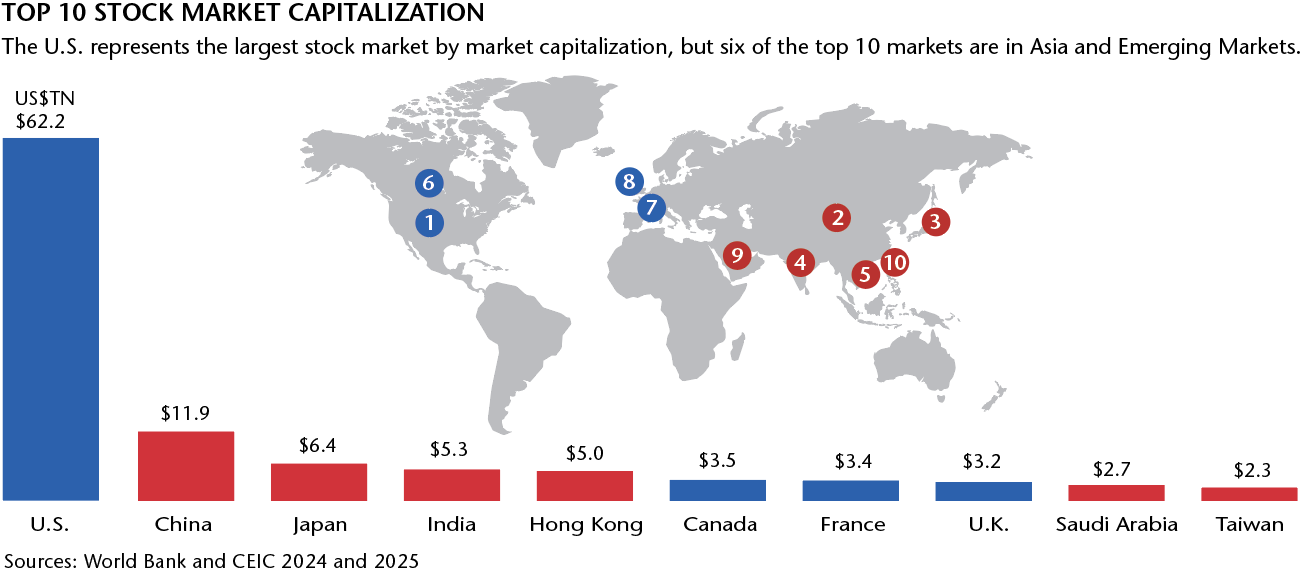

Today, Emerging Markets encompass over US$30 trillion dollars in market capitalization, with China and India as the second and fourth largest stock markets in the world.

Anywhere But America—The ABA Trade—is about as simple as it gets. It implies that the U.S. market is seriously over-priced, over-owned and facing headwinds. For those of us with a long history in the markets, this show has played before. From the peak of 2000 to 2012, the price return of the S&P 500 was basically zero. The dark days of the first technology bust tend to be forgotten, and the grim years of the Great Recession now feel like a bad dream—faded in the bright light of today’s U.S. technology dominance.

U.S. tech achievements are simply stunning. The human experience has been profoundly changed by our little flat phones and the endless connectivity they offer. Now, future change is rushing toward us, with artificial intelligence (AI) promising similar levels of social transformation—turbocharged by Asia’s vast manufacturing capabilities. But intense pain has historically been likely for investors that embraced such change. Whether tomorrow or maybe years from now, euphoria will be overwhelmed by the challenge of sustained earnings. Often the disruptors end up being disrupted. From its peak on March 10, 2000 through its trough on October 4, 2002, the NASDAQ fell 77.25%. Think about that in your 401k.

Paying hundreds of times forward earnings for companies that seem poised to own the future can pay off. Just look at Amazon. It operated at a loss for years. It then sported a price-to-earnings (P/E) ratio in the multiple hundreds as it grew to redefine how Americans shop. Today, Amazon has a forward P/E ratio of about 25 times for 2026—comparable to the NASDAQ’s forward P/E11.

Over its life as a publicly listed company, Amazon has returned a stunning 300,000%1. But what were the odds that any investor could have identified, bought and held Amazon amid the thousands of start-ups on the brink of bankruptcy during that era? (We were fond of calling them “air sandwiches.”)

The ABA Trade: Emerging from the Shadows

The ABA Trade is simply a way of saying that global diversification will be back in style at some point. Foreign markets have already begun outperforming the U.S. markets, in 20252. This trend may end soon—or it may define the next decade of investing. No one knows. Just as no one knows if the AI startups will drive economies and markets the way the internet success stories did.

As a specialist in developing Asia, I watched China emerge from the grayness of Mao’s legacy into a vital economic powerhouse. Just ten years ago, the world’s investors were lined up begging to participate in the latest Asian miracle. Now China struggles to command any respect as a destination for international capital. Being a top dog is great while it lasts, but the worm always seems to turn.

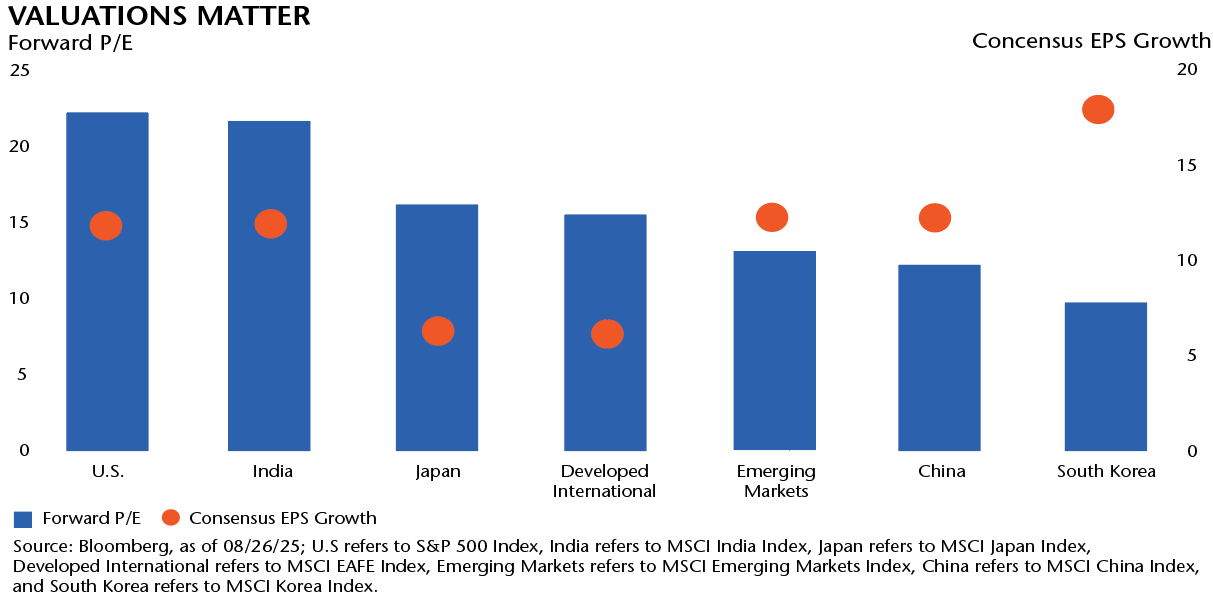

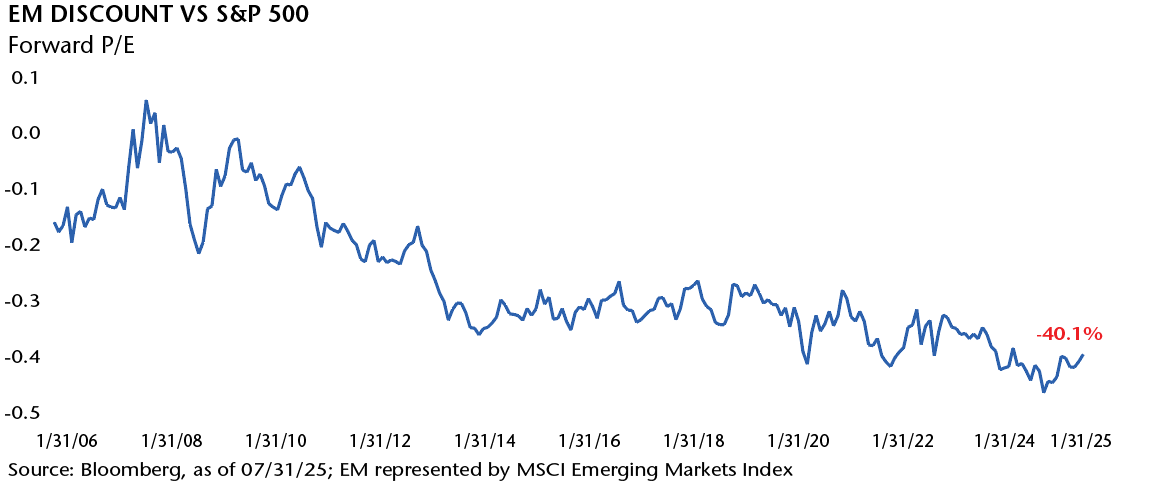

Today, U.S. markets make up over 64% of the total global market capitalization3. This is American exceptionalism in glowing neon. Other major markets have valuations ranging from India’s comparable forward P/E of about 21.8X to South Korea’s rock-bottom 9.8X. The once-mighty Japanese market sits at a solid, if humble, 16.2X. Overall, international markets trade at a 30% discount and emerging markets at a 40% discount versus the U.S. It is quite plausible that this will last.

But it is also plausible that the U.S. market will revert to its 20-year mean historical average valuation of 16.2X4, implying either a very sharp drop, or years of flat to negative returns, or perhaps both. Americans don’t like to lose. Just look at how we treat our elite sports teams when they fall from peak performance to mediocrity—or worse, miserable underperformance. We fire the coach, trade the diminished stars (except the Warriors!) and generally criticize everyone. We are a fiercely competitive nation.

Our capital markets are unparalleled in giving vast amounts of capital to entrepreneurs and charlatans alike. But there comes a point—as seen in 2000 and again in 2008—when bold investing in the future veers into intoxicated speculation. Are we able to clearly see the risks around us, or are we simply jonesing for yet another hot year?

How dangerous are the U.S. markets? Only time will tell. But personally, I am very content with my extremely diversified portfolio of global equities, including substantial exposure to Europe, Asia and the Emerging Markets. I believe many nations offer quality companies that have been somewhat ignored during a period of exceptional U.S. performance.

My career in Asian equities began at the peak of the Japanese bubble. My first boss thought investing in developing Asia was a poor use of time given the clear dominance of Japan’s economic model. China was not even a consideration in our early investing in Asia, aside from concerns about the upcoming Hong Kong handover. Imagine what surprises the future will hold.

Today, you’re likely overweight in a U.S. market that has enjoyed a fantastic run and dominates global investing. Is there a future where U.S. markets face years of headwinds while other countries make progress? Only an irrational investor wouldn’t take that question seriously.

Changing allocations can be very painful if one is not in a tax-exempt account. But consider the losses that followed previous periods of U.S. market exuberance and just think about the potential benefits of diversification—particularly if you don’t have a time horizon of decades.

Yes, foreign markets will fall as well if the U.S. market seriously cracks, but I would suggest that this could be an “exceptional” opportunity that prudent investors should be studying carefully.

The ABA Trade just may define successful asset allocation in the next decade. The currency strength of many countries versus the weakness of the U.S. dollar could be the canary in the coal mine. I learned this lesson the hard way as a young portfolio manager when the Thai baht tumbled in mid-1997, dragging much of Asia’s markets with it over the following year. The U.S. could face higher inflation, capital flight and a severe recession—even before factoring in the challenges of our current trade policies. In such a scenario, the rest of the world may become a potential safe haven.

Anywhere But America is a cheeky way of saying that no bull market lasts forever—and the longer it runs, the worse the potential reckoning. Perhaps you should keep an eye on those few purveyors of the almost lost art of value investing, and even musings of an old Asia hand like me.

Mark Headley

Executive Chairman

Matthews

1Source: Bloomberg, as of 8/26/2025.

2As of 08/31/25. Foreign markets including the MSCI EM, MSCI AC Asia ex Japan, MSCI AC Asia Pacific, MSCI China, MSCI Japan and MSCI Korea Indexes. U.S. markets as represented by S&P500.

3As represented by the MSCI All Country World Index.

4Source: Bloomberg, as of 08/26/2025

As of 08/31/25, accounts managed by Matthews did not hold positions in Amazon.

This material is provided for informational purposes only and should not be considered tax, accounting, or legal advice. Please consult your tax or legal adviser for guidance where needed.

NASDAQ (National Association of Securities Dealers Automated Quotations) refers to both a major U.S. stock exchange, particularly known for technology companies, and its stock market indices, such as the NASDAQ Composite and NASDAQ-100, which track the performance of listed securities.

MSCI All Country World Index captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. Index performance does not reflect fund performance and past performance cannot predict future results. Diversification cannot assure a profit or protect against loss in a down market.