Why Go Active in Emerging Markets

From managing exposure to leveraging growth opportunities—core active portfolio managers can unlock the full potential of emerging markets.

Watch VideoKey Takeaways

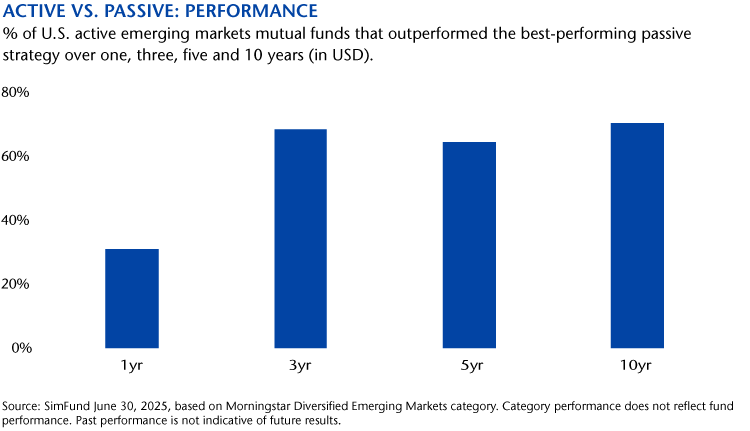

- The structural characteristics of emerging markets provide active investors with the opportunity to generate alpha—returns beyond the index and beyond passive investment strategies.

- The long-term outperformance of active investment strategies demonstrates the impact of alpha generation.

- Core active strategies can offer balance and greater flexibility than strategies with style biases, which is often key in markets where multiple variables impact returns.

- Country allocation plays a crucial role in active investment management by identifying areas that may either support or may hinder potential stock-picking opportunities.

Emerging markets, we believe, offer compelling opportunities. One of the choices investors need to consider when seeking exposure to the asset class is how active they want their exposure to be. Passive equity strategies have successfully harnessed robust U.S. equity returns over the past decade. Does the same playbook apply to emerging markets? The merits of passive investing can be argued for emerging markets, as they can for most equity markets. However, we believe that to generate sustainable returns over the medium to long term, the role of an active strategy is also crucial.

In contrast to the U.S. and other developed markets, emerging markets comprise multiple economies at different stages of development—some facing headwinds, others benefiting from tailwinds. Emerging markets tend to be less efficient and are often under-researched. Despite their vast scope, indexes can also become concentrated in a small number of companies as market capitalizations or free floats increase and these companies may not necessarily be best positioned to provide attractive future returns. In our view, these factors create an opportunity for active managers—through research, local expertise and fundamental investing—to generate alpha that exists beyond the scope of index products and many smart beta strategies.

We believe actively managed funds can be a vehicle for exposure to emerging markets and a complement to passive investments in the asset class; they are a platform that can identify and unlock opportunities within these complex markets, often outside benchmark indexes, and we would argue the long-term performance of these strategies proves this.

Why Active Investing Works for Emerging Markets

When considering adding or increasing exposure to emerging markets, investors should also be cognizant of the different types of active strategies that are designed to generate alpha. In our view, a core active approach—unconstrained by index composition or by investment style—offers both flexibility and balance.

Core active strategies have the flexibility to make portfolio decisions across markets and take different tactical postures, be it more aggressive or more cautious. They can also seek opportunities in small-cap companies or probe deeper into thematic trends. In contrast, some actively managed strategies can tilt toward value, growth or momentum investing, which can be restrictive if the market environment is not aligned with the style bias. The latent strength of the core active approach, however, is in the ability to have greater—or lesser—exposure to markets. We believe this flexibility is the foundation for generating long-term returns that outperform the index.

We can distill the strengths of core active investing in emerging markets into five key areas:

- Countries Matter

Domestic political developments or economic policy changes can directly influence company earnings and market sentiment. While domestic variables have always been important in emerging markets, their influence has amplified in recent years and they can contribute to wide dispersions in the returns at the country level. It points to the importance of country allocation in managing exposure and also the potential for alpha generation in the asset class.

- Importance of Stock Picking

Assessing company fundamentals, management teams and the growth trajectory of a business is at the core of generating market outperformance. This process requires deep analysis of financials, competitive advantages, supply chains, capital efficiencies, management quality and business outlook. Evaluating governance standards is also crucial. Poor standards can undermine earnings growth and profitability, and active investing can play a crucial role in screening out companies with substandard governance and weak regulations. More importantly, good governance research is a key tool that enables active managers to add exposure to companies with weak standards at the right price and to engage with those companies to improve their governance, thereby improving investment return potential.

- Portfolio Construction

A key strength of core active management is the scope to invest across companies, markets and cycles. Part of this strength is the ability to vary or avoid exposure to holdings and markets included in benchmark indexes. In addition, being intentional about active risk in portfolio construction is critical to achieving investor return goals and consistent performance. In our view, aggregate active risk in a portfolio should align with a strategy’s outperformance target to ensure the manager has the potential to deliver the expected risk-reward profile for investors.

- Market Mispricing

Emerging markets are generally less efficient than those of advanced economies. This may be in terms of volume of liquidity, scope of capital markets or the availability of information. For example, in markets with minimal equity analyst coverage, the level of information to passive investors is limited. In contrast, portfolio managers can gain a more comprehensive understanding through proprietary research of markets and companies.

- Focus on Alpha

For most investors, we believe an index-aware, fundamental active core strategy can be an appropriate way to generate sustainable investment returns over the medium to long term. Passive strategies can efficiently replicate an index and have lower tracking errors. They offer simplified exposure to emerging markets which can be less effective if the market itself is volatile or in decline. Alternatively, smart beta and quantitative strategies offer style biases, such as a growth or value orientation, as a way of filtering a desired opportunity set for investors. These biases can lead to wider tracking errors and may result in investment returns that differ from the index.

The core approach prioritizes generating alpha. It allows active managers to navigate across countries, markets, sectors and companies, embracing different styles and taking thematic positions. Core active managers can add value at both the country and stock level, control exposure to market risk and maintain flexibility over what markets to invest in.

Active on the Ground

Jeremy Sutch, CFA,

Emerging Markets ex China Portfolio Manager

As active managers, we evaluate investment opportunities and challenges by assessing variables that may impact the key drivers of investor returns: earnings, dividends, currencies and valuations. These variables influence our portfolio weightings across countries, sectors and individual stocks. While some markets have significantly higher index weights due to the size of their economies and investible stock universes, our allocations also reflect an active assessment of risk and reward. This enables us to be overweight or underweight in a market relative to the benchmark index.

When it comes to specific country bets and stock picking, our active process takes us to where the potential rewards may be more bountiful—whether in more heavyweight countries or in smaller or out-of-index markets. As with large economies, the investible universes of smaller countries can contain high-quality, well-managed, innovative companies. For example, we may examine ride-sharing and e-commerce opportunities in Indonesia and Thailand, small caps in China, defense sectors in South Korea, or fintech expansion in Brazil.

Beyond earnings and growth prospects, we pay close attention to company valuations. Emerging markets are not as efficient as developed markets and companies with strong fundamentals frequently trade at unjustified deep discounts—even when adjusting for higher risks—relative to market peers.

Vietnam: Beyond tariff crosshairs

Vietnam is a centrally controlled, export-driven economy that has successfully attracted foreign direct investment (FDI). This has spurred the growth of a broad range of manufacturing activity powered by a young labor force and has fueled an emerging middle class and urbanization trend.

In April, Vietnam came under the spotlight when President Trump’s reciprocal tariff policy threatened a cyclical downturn. However, under the pragmatic and growth-focused leadership of General Secretary To Lam the government appears to have managed these risks astutely. Lam has focused on driving efficiencies, cutting red tape and has brought in a new real estate law that accelerates land purchases, construction and pre-sales license approvals. The government also hedged against what appeared to be a high probability of a negative trade agreement with the U.S. by focusing on some growth initiatives, including a sizable fiscal stimulus package.

Having deep, local knowledge of Vietnam’s economy and politics as well as its equity markets provides valuable perspective for the active manager on the opportunities and challenges that have been triggered by U.S. tariffs and other developments Vietnam is not included in major emerging markets benchmark indexes but, in our view, it remains a structural growth opportunity for active investors.

The Broader View

Sean Taylor, CIO,

Emerging Markets Portfolio Manager

We look at emerging markets in three broad ways and this helps us understand their role in the global economy, particularly from a macroeconomic and currency perspective:

- Markets including China and India which are more domestically driven and less sensitive to global developments and currency fluctuations

- Markets dependent on technology, global supply chains and the U.S. economy, such as the semiconductor-focused economies of Taiwan and South Korea

- Traditional emerging markets like Brazil and Indonesia which are influenced by global macro factors, such as U.S. interest rates and the U.S. dollar, as well as internal domestic policy gyrations.

We then use a range of tools to understand and leverage the opportunities that each grouping presents. As bottom-up stock pickers, we dig deeper to find better opportunities within or across these categories. We can also generate alpha by being overweight or underweight in specific countries or sectors. Additionally, as active managers, we can adopt different investing styles, such as value or growth, and focus on small, mid or large-cap companies.

We also assess the variables that could impact the drivers of return in country markets. These can be a change of government, fiscal stimulus or contraction, new regulations, or trade restrictions and tariffs. For example, we may evaluate how heightened border tensions with Pakistan affect Indian valuations, how China’s anti-involution initiatives influence country risk premiums, or how South Korea’s “value-up” governance program impacts mid-term normalized dividend payout ratios.

When markets encounter extreme challenges, such as war or conflict, we need to act swiftly to adjust our exposures. Passive strategies can remain exposed to troubled markets until the index removes the exposure. Additionally, we can invest beyond the benchmark into frontier markets before they are upgraded to the emerging markets index. It means we can position early for potential long-term investment returns. Initial public offerings (IPO) also provide opportunities for active investors to gain exposure to new public companies at the outset. We conduct thorough due diligence to determine the prospects for companies coming to market and make investment decisions based on fundamentals rather than market sentiment.

Importantly, we also engage directly with companies. Passive strategies may have some contact through proxy advisers but they do not have access to management. By getting to know companies, we gain better understanding of their earnings growth potential, dividend strategies and the factors that may impact their valuations. For example, in one market, earnings growth may be the clear driver of returns, while in another, valuations uplift may be the bigger influence. Communication with management also enables us to push companies for changes that can significantly improve prospects for investment returns.

Opportunities in Challenging Times

Every emerging market is different and, in our view, active management is an effective way to participate in upside potential. As active managers, we focus on the fundamentals of companies and assess their robustness and governance. It may mean that we miss out on the froth in the market but we also avoid the downside.

At the start of 2025, investor sentiment was influenced by a belief that U.S. exceptionalism would continue, underpinned by a strong U.S. dollar and a hawkish Federal Reserve—factors that were not conducive to emerging markets outperformance. Adding to these headwinds were political upheavals in countries such as the Philippines, South Korea and Thailand, as well as the U.S.’s imposition of reciprocal tariffs on its trading partners.

This environment created fear and uncertainty among many investors. However, as active managers, we identified significant alpha-generating opportunities in the dislocation between price and value of companies and country markets. Looking at the world today, we are confident that active managers can help to leverage the substantial long-term opportunities that emerging markets offer.

Definitions

Smart beta refers to an enhanced rules-based strategy that seeks to exploit certain performance to outperform a benchmark index.

Tracking Error: Measures the average of excess returns between a strategy and a benchmark index.

IPOs of securities issued by unseasoned companies with little or no operating history are risky, and their prices are highly volatile, but they can result in very large gains in their initial trading. Attractive IPOs are often oversubscribed and may not be available to the Funds or may be available only in very limited quantities.