China's Economic Resilience

China’s economic recovery continued during the second quarter with consumer spending back strongly. But, with ongoing U.S. – China tensions likely to worsen, will it also derail China’s economic recovery?

"The downward spiral in U.S.-China relations is likely to worsen, but is unlikely to derail China’s economic recovery."

China's V-shaped economic recovery continued for a fourth consecutive month in June, led by strong domestic demand. If COVID-19 remains under control, China can remain the world's best consumer story.

On the 19th anniversary of the publication of “The Coming Collapse of China,” it is worth noting the resilience of the Chinese economy, which has survived the Global Financial Crisis, the Trump tariffs and now the coronavirus. In 2001, author Gordon G. Chang forecasted that China's “economy, and the government, will collapse. We are not far from that time.” Instead, last year China accounted for 40% of global economic growth, larger than the combined contributions to global growth of the U.S., EU and Japan, according to IMF data.

All of us at Matthews Asia send our sympathies to everyone effected by COVID-19, either directly or indirectly, and we extend our gratitude to all health care professionals, scientists and service providers who are diligently working to help and provide care to those in need around the world.

An ongoing V-shaped recovery

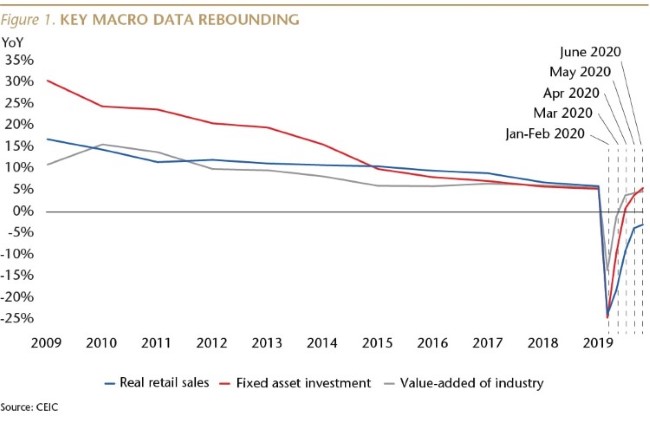

In April, we noted that China's first quarter macro data was the weakest since the Tang Dynasty. We also pointed out that across most of China, life began slowly returning to normal in the second half of March, leading to signs of a nascent recovery in that month's data. That recovery continued to strengthen during the second quarter.

China's economy is increasingly driven by domestic demand, so it is important that consumer spending has continued to bounce back. Last year was the eighth consecutive year in which the consumer and services (or tertiary) part of China's GDP was the largest part. Although consumer spending is likely to remain softer than usual until next year, on a relative basis China is likely to remain the world's best consumer story.

Consumer spending back strongly

Inflation-adjusted (real) retail sales plummeted to a 23.7% year-over-year (YoY) decline in January/February, during the peak of China's COVID-19 outbreak, but was down only 2.9% in June. A healthy recovery, but not yet back to normal: in June 2019, real retail sales rose 7.9% YoY.

Auto sales rose at the second fastest YoY pace since January 2018, with sales up 11.6% in June, after rising 14.5% YoY in May, in contrast to a decline of 79.1% YoY in February.

This is consistent with data reported by several publicly traded global car makers. BMW's 2Q China car sales rose 17% YoY, while their sales fell 40% in the U.S. and declined 46% in Europe. Mercedes-Benz said it's “best second quarter to date in China shows the impressive speed at which demand is currently recovering in our largest market.” Toyota's June sales in China rose 22.8% YoY, while Ford said its 2Q vehicle sales rose 3% YoY, its first quarterly sales rise in China in almost three years. Of course, not every carmaker had success: GM said its 2Q sales in China fell 5.3%.

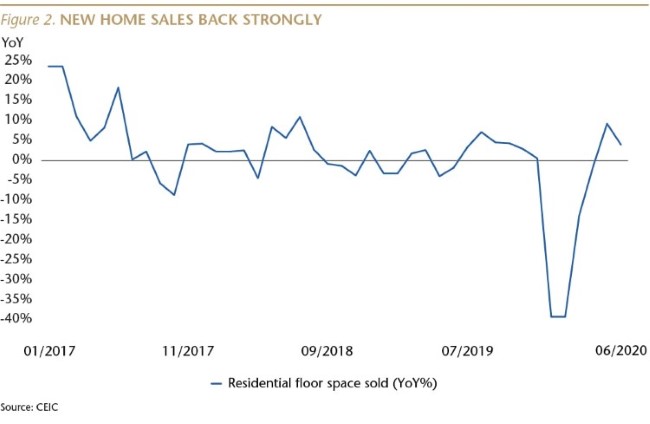

Residential property sales also continued their strong recovery last month. After being down 39.2% YoY (in square meter terms), in January/February, sales rose 4%, following a 9.3% rise in May. (In June 2019, sales fell 1.8%.)

It is worth remembering that the overwhelming majority of new home buyers in China are owner-occupiers, who are required by regulation to make a cash down-payment of at least 20% of the purchase price. A July study by the China Quantitative Insight (CQi) team at Credit Suisse found that investors accounted for less than 20% of buyers across the country.

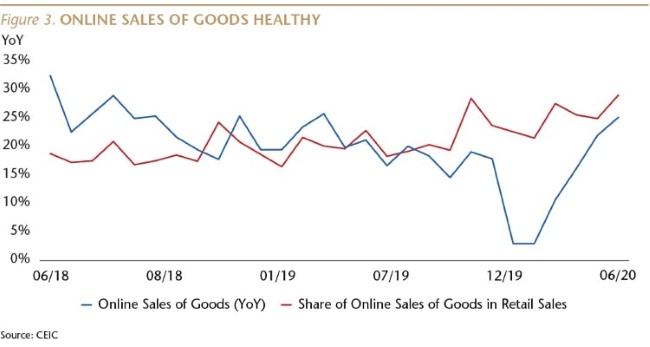

The recovery of sales of autos and homes reflects that middle-class and wealthy consumers have both sufficient money and enough confidence in the future to spend it. And it wasn't only big-ticket items that bounced back last month. Online sales of goods rose 25.2% YoY in June, up from 22% YoY in May and 10.7% in March, and faster than the 21.2% YoY pace a year ago. During the first six months of the year, online sales accounted for one-quarter of total retail sales.

Sales at food services and drinking places rose 8.3% month-over-month in June, after month-over-month increases of 31% in May and 26% April. Restaurant and bar sales were still down 15.2% YoY last month, due in large part to lingering fears many people have about gathering indoors, but the sector is beginning to recover. It is likely that this part of the economy, as well as other businesses that require customers to gather in confined spaces, will take a long time to fully recover. This is why I expect China's economic activity to return to about 80% of normal by the end of this year, with the final 20% of the recovery unlikely until after an extended period time with very few new COVID cases in China, the global pandemic under control, or the development and widespread use of an effective vaccine.

The improvement in consumer spending and sentiment has come in advance of a full recovery in income, suggesting a fairly high degree of confidence in the future. As most businesses reopened, nominal per capita disposable income increased 4.5% YoY in the second quarter, stronger than the 0.8% rise in 1Q20, but still far below the 8.9% pace a year ago.

CapEx recovering

Fixed asset investment also continued to improve last month, including by privately owned companies, whose CapEx spending only declined 1.1% YoY, following a decline of 2.6% YoY in April and a 26.4% fall in January/February. Not yet back to normal (private firm CapEx rose 6.8% YoY a year ago), but heading in the right direction.

Last month, investment in infrastructure rose 6.8% YoY, up from 2.3% in April and a decline of 30.3% during the first two months of the year. This was the second fastest monthly growth rate in two years, and, along with new fuel efficiency requirements, helped drive a 75% YoY increase in domestic excavator sales in June, following a 77% rise in May.

Recovery without a stimulus bazooka

It is significant that this healthy economic recovery has come without a dramatic stimulus. Credit growth, for example, has only accelerated modestly. Augmented Total Social Finance (TSF) outstanding, the broadest metric for credit growth, was up 12.9% YoY by the end of June, compared to an 11.5% growth rate during the same period in 2019. Far from the 31% growth rate during the same period in 2009, when Beijing implemented a massive stimulus in response to the Global Financial Crisis. This highlights the strength of an organic recovery, and leaves the government with plenty of dry powder if the recovery were to falter.

Moreover, the government's long-running effort to de-risk the financial system continues. Off-balance-sheet lending outstanding declined by 5.4% YoY in June, the 25th consecutive month of falling shadow lending activity.

Unemployment remains a concern, but the absence of social unrest and the continuing rebound in consumer spending suggests that the government's support for workers and businesses has provided a cushion for many who lost their jobs, laying the foundation for an economic recovery. But if services companies in hospitality, entertainment and travel take a long time to return to normal levels of business (due to COVID fears), unemployment (or underemployment) among migrant workers will persist, exacerbating income inequality.

Regular readers of Sinology know that we rarely discuss GDP growth rates, as the other macro data outlined in this report is easier to verify and more useful for investors. But, for the record, China reported a second quarter real GDP growth rate of 3.2% YoY. That's up from a decline of 6.8% YoY in 1Q20, but down compared to the 6.2% pace in the second quarter last year. In a June update to its World Economic Outlook, the IMF forecasts that China will be the only major economy to grow on a YoY basis in 2020, and the Fund forecasts 8.2% YoY GDP growth for China next year. In my view, the IMF's China forecast growth rate for next year is too high, but I agree with the overall trend.

COVID-19 remains the key economic risk

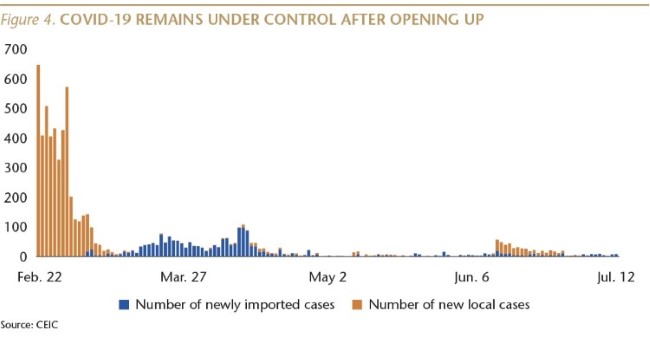

Whether the V-shaped economic recovery described here continues depends primarily on the Chinese government's ability to continuing keeping the coronavirus under control. At this point, there are reasons to be optimistic.

In the first 14 days of July, there were a total of only 77 new COVID-19 cases in China, and of those, only seven were the result of local transmission (the others were among people who had arrived from abroad with the disease). In contrast, during the first 14 days of July, there were 816,221 new cases in the U.S. and 8,120 in the UK.

On July 14, there were 284 patients in Chinese hospitals with COVID-19, down from 58,016 on the February 17 peak. On July 14, there were 55,509 COVID patients in U.S. hospitals and 1,392 patients in hospitals in England.

In the first 14 days of July, there were no COVID deaths in China. During that period of time, there were 9,093 COVID deaths in the U.S. and 1,238 in the UK.

The mid-June COVID outbreak in Beijing is a cautionary tale for all nations, suggesting that eradicating the virus will be extremely difficult, but also re-enforcing the need for large-scale testing and contact-tracing, as well as continued mitigation efforts such as social distancing and face covering. Beijing, a city with a population of 21.5 million, went almost two months without a new case, but then recorded 158 new cases in seven days. The city responded by shutting many shops and schools in the hardest-hit neighborhoods, and by conducting more than 11 million tests in the city within 25 days. As a result, during the first 14 days of July, Beijing reported a total of seven new cases and no new deaths. Contrast that with the state of Florida, which also has a population of 21.5 million, and a significantly lower population density. During the first 14 days of July, Florida reported 139,195 new cases and 904 COVID deaths.

I know that some investors wonder whether the Chinese government's COVID data can be trusted. I think there are two reasons to believe that since January 23rd—when the government shut down the city of Wuhan, where the virus was first identified, and which has a population larger than that of New York City—the Chinese government has not been deliberately falsifying its COVID data. First, if the number of hospitalizations and deaths were significantly higher than the official statistics, we would be hearing about it on social media from the family and friends of those patients.

Second, the data reported by China has been consistent with data from other places in the region which undertook similarly aggressive efforts to control the virus.

For example, Japan has reported only 10 deaths in the first 14 days of July, and a total rate of COVID-19 deaths per one million population of eight (the rate is three in China). South Korea has reported seven deaths in the first 14 days of the month and a fatality rate of six per one million population. Thailand has reported no deaths this month and a fatality rate of 0.8. Taiwan has reported zero deaths this month and a fatality rate of 0.3. New Zealand has reported no deaths too this month and a fatality rate of four per one million population.

China is not export-led

Finally, I would like to once again remind readers that because China is a domestic-demand driven economy, there is a low risk that a possible COVID-driven global recession, or the on-going downward spiral in U.S.-China relations might derail the recovery. Last year, domestic consumption accounted for almost 60% of GDP growth. The gross value of exports was equal to 17% of China's GDP (down from 35% in 2007), but almost 30% of those exports were processed goods for which little value was added in China.

Significantly, over the last five years, net exports (the value of a country's exports minus its imports) have, on average, contributed zero to China's GDP growth. Moreover, only 17% of China's exports went to the U.S. last year. So while a collapse in demand for Chinese exports would be a drag on the recovery, it would likely be a modest drag

Andy Rothman

Investment Strategist

Matthews Asia

As of June 30, 2020, accounts managed by Matthews Asia did not hold positions in Bayerische Motoren Werke AG, Daimler AG, which owns Mercedes-Benz, Toyota Motor Corporation, Ford Motor Company and General Motors Company.