The Power of Sustainable Research

Head of Responsible Investment and Stewardship Kathlyn Collins explains the value of proprietary research and the limits of third-party scoring for sustainable investing in emerging markets.

While it’s important to consider emerging markets through a sustainable lens as the world moves toward lower emissions, it’s also critical to think about sustainability-related issues with an emerging markets filter.

It won’t be surprising to learn that emerging markets in Asia and elsewhere are generally less transparent than developed markets with regard to information disclosure. Much of the developed world—especially the European markets—are miles ahead of emerging markets when it comes to the reliability and consistency, and even the availability, of key sustainability data.

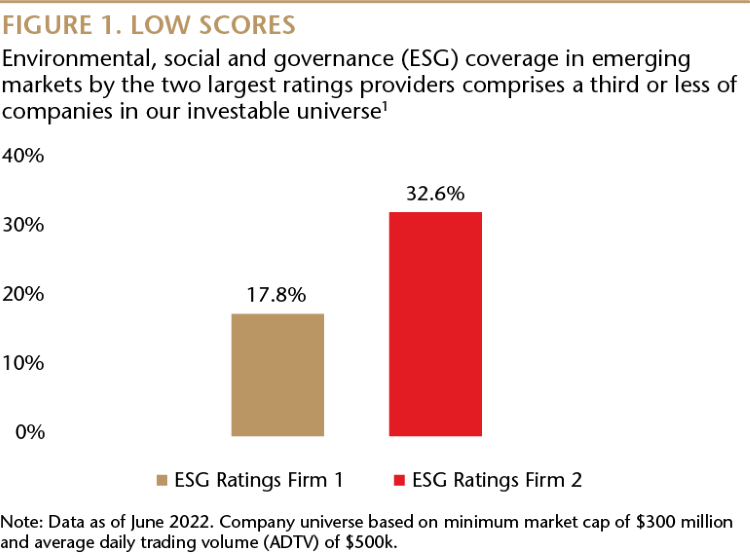

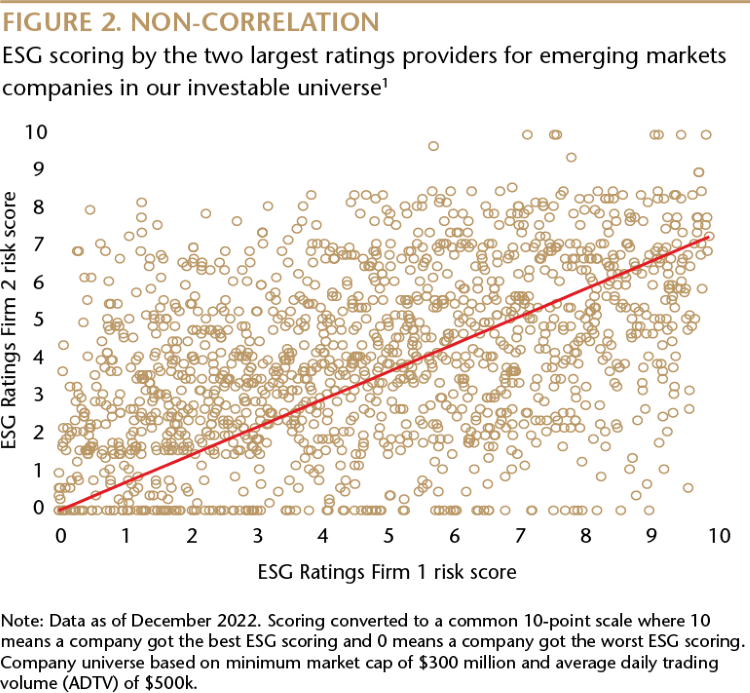

In developed markets, many portfolio managers rely on third parties to provide sustainability ratings and scorings for companies but this approach is challenged in emerging markets because of the paucity of information. The two largest ratings providers, for example, cover a third or less of companies in our universe of investable companies. Scant data and inconsistency of data also means there is a lack of correlation between ratings providers. Correlation in scores between most providers doesn’t even reach 50%—as compared with long-term debt ratings, which show correlations in the 94% to 96% range. And these challenges are magnified for certain asset classes, like small- and mid-cap companies in emerging and frontier markets where the data is very thin. Crucially, many of these companies, in our estimation, offer some of the most compelling opportunities for sustainable investing.

Sustainability issues are also rarely black and white. It is extremely difficult to implement a sustainability-focused strategy through common mechanical and rules-based approaches based solely on third-party inputs. We would argue that while the availability and consistency of sustainability data in emerging markets needs to be improved, it is critical for asset managers to be engaged in their own research. Even if the third-party data were more available and reliable, there are open questions about the value of an overly rules-based approach which can naturally lead investors to overlook nascent opportunities.

"Available data for small- and mid-cap companies in emerging and frontier markets is very thin yet some of these businesses offer the most compelling opportunities for sustainable investing."

When we are assessing a company, we also often contextualize our assessment depending on the local market and its form of corporate governance. For example, in Brazil, a state-owned enterprise may have a low employee turnover ratio which could be seen as an indicator of happy, productive employees when in reality, state-owned companies in Brazil have strict labor laws that make it hard to fire workers. Similarly, a standard three-committee board of directors at the top of a company may look different in a market like Indonesia. So these nuances are important.

Dig deeper

We believe local knowledge of the most important sustainable issues in a specific market is key. Sustainability is subjective; it’s not a metric like volatility or profitability that can be easily measured. Every market has its own approach to corporate law, shareholder rights and regulation, which makes measuring broad portfolios on sustainability considerations both challenging and of limited value. On the contrary, expecting some variability among companies is healthy and provides a different perspective among market players.

On first blush some companies may not seem wholly sustainable but they may be on the right—and necessary—path and could prove fruitful sustainable investments in the long term. A good example would be a China-based battery equipment manufacturer mainly focused on the core back-end battery manufacturing process. Its top customers are lithium-ion EV battery makers, and we would consider it a key part of the EV value chain. However, the company could get low scores for clean-tech opportunities because of the way ratings agencies evaluate its operating energy efficiency disclosures. Based on our research, we would view the company as being inaccurately scored. This example illustrates how some sustainable opportunities are only open to active investors capable of conducting detailed proprietary research.

It’s also important to take a wide view of secular growth opportunities. For example, renewable energy, transportation, industry, e-commerce and finance, all offer fertile ground when it comes to the opportunity for emerging markets countries to move toward a more sustainable future. Over the long term, these opportunities have tremendous potential value—not only for investors but for all stakeholders, including, importantly, local and global populations. Without this perspective, these considerations are challenging to factor in and there’s a risk of overlooking some of the most exciting opportunities which may be small or even off-benchmark.

What it all means is that portfolio managers have to do their own research and dig deep. We believe the differences in disclosure and data availability between emerging markets and developed markets present significant opportunities for investors willing to sift through the noise and identify compelling investment candidates that will advance and grow in a sustainable fashion.

In our view, many of the fastest-growing companies in the sustainable emerging markets space have yet to be discovered by mainstream indices and ratings agencies. We believe that in-person, on-the-ground research, combined with experienced, active portfolio management, is fundamental to help uncover these opportunities.

Kathlyn Collins

Head of Responsible Investment and Stewardship

Matthews Asia

1 ESG ratings firm 1 - Sustainalytics; ESG ratings firm 2 - MSCI

Disclosures and Notes

ESG considerations are not a specific requirement for all portfolios at Matthews Asia. ESG factors can vary over different periods and can evolve over time. They may also be difficult to apply consistently across regions, countries or sectors. There can be no assurance or guarantee that a company deemed to meet ESG standards will actually conduct its affairs in a manner that is less destructive to the environment, or promote positive social and economic developments than a company that does not meet ESG standards.

Investments involve risk. Investing in international, emerging and frontier markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in Chinese securities involve risks. Heightened risks related to the regulatory environment and the potential actions by the Chinese government could negatively impact performance. Additionally, investing in emerging and frontier securities involves greater risks than investing in securities of developed markets, as issuers in these countries generally disclose less financial and other information publicly or restrict access to certain information from review by non-domestic authorities. Emerging and frontier markets tend to have less stringent and less uniform accounting, auditing and financial reporting standards, limited regulatory or governmental oversight, and limited investor protection or rights to take action against issuers, resulting in potential material risks to investors. Pandemics and other public health emergencies can result in market volatility and disruption.

Important Information

There is no guarantee any estimates or projections will be realized.